5 min read

Increasing First Pass Payment Success in Your Revenue Cycle

By: Lori Zindl on Sep 10, 2019 9:40:08 AM

In a perfect world, your claims would leave your business office “clean” and be paid promptly.

No denials, no delays, and no reductions in payment. But the world of health care providers and payers is not perfect; nor is it simple.

Increasing the number of claims that get paid on the first submission takes time, effort, and quality control. It is possible, however, to apply strategies that help reduce avoidable claim denials – those that could be prevented by your organization – and take a critical step toward improving revenue cycle management.

What is a Clean Claim?

Medicare defines a clean claim as a claim that has no defect, impropriety or special circumstance (including incomplete documentation) that delays timely payment.

The Michigan Department of Insurance and Financial Services says it means a claim that does all the following:

- Identifies the health care professional or facility that provided service, including any identifying numbers.

- Identifies the patient and health plan subscriber.

- Lists the date and place of service.

- Provides proof of covered services for an eligible individual.

- If necessary, substantiates the medical necessity and appropriateness of the service provided.

- If prior authorization is required for certain patient services, contains information adequate to establish that prior authorization was obtained.

- Ascertains the service rendered using a generally accepted system of procedure or service coding.

- Includes additional documentation as reasonably required by the health plan.

If your claims are being rejected for failure to provide any of these items, it’s wise to create steps or add edits to your claim scrubber that address the problem(s) by tracking the reasons behind your frequently denied claims.

Preemptive Registration

The front end of the revenue cycle team, otherwise known as Patient Registration or Patient Access, has grown increasingly vital to the clean claim process.

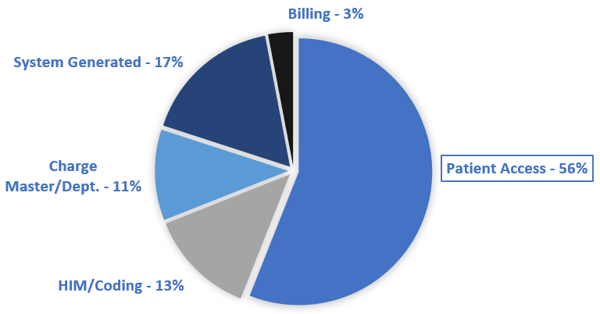

In fact, if you look at the data required on an Institutional claim (UB04), Patient Access is responsible for over half of the fields making up the claim form.

These employees collect demographic data including a patient’s name, address, date of birth and Social Security number. Any missing or inaccurate items may not only jeopardize payment but also put patients at risk if they are incorrectly identified. For example, there may be several patients named Robert Anderson in your system, making the date of birth an essential identifier.

Eligibility

Getting the right demographic information doesn’t mean much if the patient’s insurance has lapsed. You’ll need to be certain that insurance coverage exists. It isn’t enough to ask the patient, “Has anything changed since your last visit?” Staff must go over each item with the patient.

An industry study from HIMSS (Health Information Management Systems Society) reveals one of the most common causes of denials that could be prevented by Patient Registration is the failure to determine if precertification or preauthorization is necessary.

Most health care providers attempt to collect and verify this information some time (perhaps five days) before the patient appears for treatment by contacting them online or by phone. If a problem is discovered, there still may be time to get the correct data. Most insurance plans have timely filing limits to getting paid so identifying problems and resolving them promptly is important.

Do you ask for payment upfront?

When you verify current coverage, it is smart to identify the patient’s deductible and co-payment so you can ask for it during preregistration or at the time of service.

The Bill

The billing department is a kind-of final inspection department that does a final quality check to get a clean claim out the door. Too often, billing systems allow claims to go out without double-checking any of the registration information which creates denials and lowers your first past payment rate. Create edits like these that stop claims before submitting if data is missing or incorrect:

- Authorization field is blank on services that require authorization for the payer being billed

- Medicaid is primary to another insurance on the claim – Medicaid should be payer of last resort

- Subscriber ID does not match the format of the ID for the payer being billed

Training

It should be obvious that training is critical if patient access employees are to comprehend the magnitude of their role in creating a claim. Training is important for new employees, of course, but it should also be an ongoing process for all employees. Don’t let training fall by the wayside due to busy schedules and other duties. Most employees make errors in the same areas only because no one has corrected them or properly trained them.

Leverage Your Denial Tools

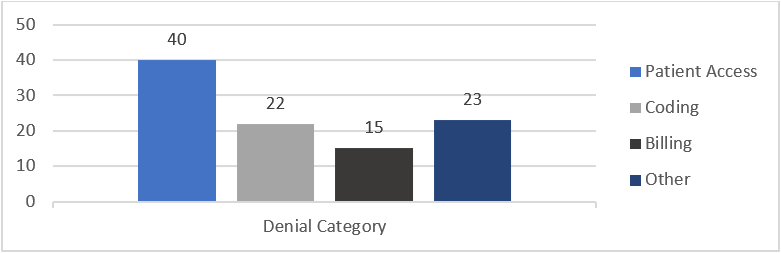

In addition to supporting better registration or access processes and building better claims edits, most denial management tools can easily be leveraged to spot denial trends caused by continuously changing payer rules. You can use this type of audit to reveal staff training needs.

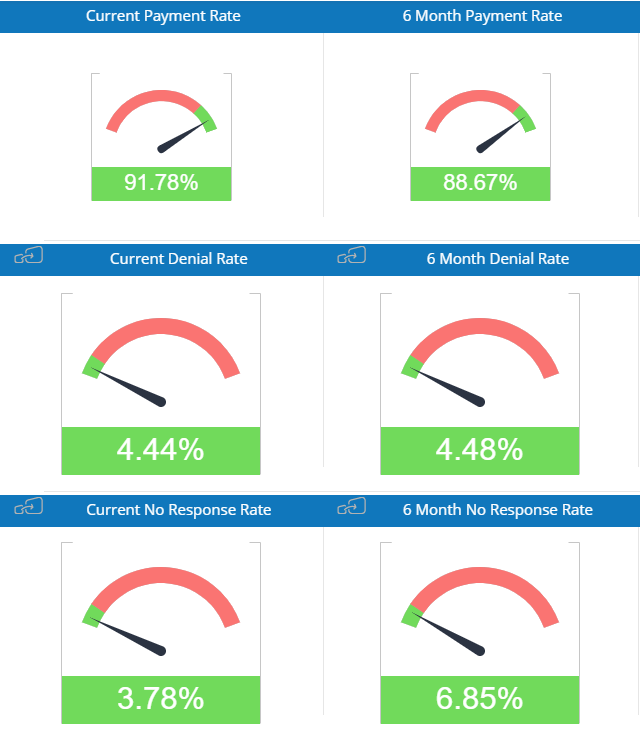

Getting into a routine of using analytics and reporting tools will enhance your ability to implement edits and process change quickly to limit denials and increase the number of claims accepted on the first pass.

It’s no surprise that with Patient Access being responsible for over half of the fields on the claim form, denials related to missing or incorrect registration data lead the pack on first pass denials.

Using analytics to identify denials by department is a great way to provide feedback to the Patient Access team on claim denial issues. We’ve worked with many registrars who were surprised when they started to see the details on claims that didn’t get paid because of errors on their part. The typical first response is “No one ever told me!”

Revenue Cycle Matters Tip: Find a business partner who provides a comprehensive solution for your revenue cycle team. You’ll get more value and see greater productivity using a tool that handles clearinghouse, claim scrubbing, remittance management, and analytics on one platform.

There’s an almost built-in risk of errors in medical billing and claim processing due to the changing rules and procedures, and the number of stakeholders involved. Identifying problems early and addressing them promptly with a clearinghouse like efficientC you can save significant time and resources.

Consider efficientC to Improve First Pass Yield

efficientC was built with the sole purpose of improving A/R performance – which includes improving GDRO, cash flow, aging, write-offs, and more.

One of the most comprehensive revenue cycle management products available, efficientC is a clearinghouse, best in class claim scrubber and a powerful analytics platform that provides the tools needed to get claims processed correctly fast.

efficientC’s power extends beyond the software itself. efficientC combines software and people to deliver industry-leading results. Our revenue cycle experts are with you from the start and will be your guide all along the way.

Uncompromising support – that’s the efficientC difference.

If you’d like to learn more and see how efficientC could help increase your first pass payment success, get in touch here or send an email to efficientC@os-healthcare.com with a few times to connect!

For more revenue cycle management insights and collections best practices, make sure you check out and subscribe to Revenue Cycle Matters.

Related Posts

Increase Satisfaction and Reimbursement by Knowing What Patients Want

If you ever doubted that interactions between patients and your registration and billing staff are...

Improve Your Collection Rate As Patient Balances Grow

High deductible plans and increasing copays and coinsurance are driving patient balances up. This...

Patient Experience: More Than a Trend in RCM

In today’s healthcare environment, patient financial responsibility has increased dramatically —...