...and How to Solve Them

The healthcare industry is acclimating to a world in which COVID-19 persists. As regulations and mandates are regularly being introduced, providers are facing problems affecting the revenue cycle.

Here are three common challenges we've seen:

-

Staying up to date on new billing and coding guidelines.

-

Addressing revenue cycle shortfalls.

- Managing a remote workforce.

Staying on Top of Guidelines

Rules and regulations seem to change every day as new information emerges regarding COVID-19. With them, coding and billing policies shift to account for the latest information.

Claim processing problems are being driven by the failure of data sets with new COVID-19 codes to be properly loaded and tested by providers as well as claims processors. If codes are not appropriately loaded, claims may be rejected or denied.

Providers are wise to follow coding and billing guidance from the CDC, CMS, AMA, and other organizations – those provided from a visit perspective, as well as the telehealth and the CPT codes, but also the guidelines that have been provided by the CDC for actually coding patients who have COVID, as reported in RevCycleIntelligence. This is important as some hospitals are seeing greater inpatient demand.

The following sites contain helpful resources:

Addressing Revenue Shortfalls

Claim denials or rejections, along with the fact that elective procedures and treatments were postponed to make room for patients with COVID-19, has created a cash flow slowdown for providers.

For example, one provider noted that their organization was seeing a trend of patients avoiding treatment in the ED throughout the pandemic. ED numbers were significantly lower, having a big effect on revenue and cash flow.

Making matters worse, a glitch is being seen with some employer-sponsored coverage. For example, if a payer is functioning as a third-party administrator, the payer might forward questions about billing and payment to the employer/purchaser of the insurance.

One billing expert warns that this is where game playing may ensue regarding when coverage began or what coverage is provided, particularly if the patient was in lay-off status with the employer.

Case in point: When a patient is older and has other health conditions (in addition to COVID-19), the other conditions are treated, but may then cloud the payment question if eligibility is an issue.

Providers need to call (and keep calling) payers and find out how claims are being processed. If payers are keeping all the premiums they are receiving as they normally do, and they have not accurately loaded the new codes, providers are within their rights to ask for interim monthly payments to match their pre-COVID payments.

This can help keep cash flowing until after the payer catches up. And, it has been working with some payers.

Managing the Remote Workforce

With accounts receivable staff working from home, provider revenue cycle teams don’t have the control they had when everyone was in-house.

How can you ensure employees stay engaged and maintain productivity levels? What are some methods that will help coders and a/r specialists work more successfully, productively, and compliantly from home?

Consider implementing the following ideas from industry insiders:

-

Use daily quotas to speed claims processing and support steady cash flow.

-

Establish some easy quality-control audit protocols to head off underpayments.

-

Implement remote working policies that reduce HR headaches.

-

Ensure timely claims processing happens with simple tracking tools; and

-

Get off-site billers to exceed your current appeal rate to get more claims paid.

A potential resource for managing your team: Healthcare Training Leader.

Have questions? Let us know by commenting below.

If you like what you read, be sure to subscribe to Revenue Cycle Matters for healthcare billing best practices and industry tips!

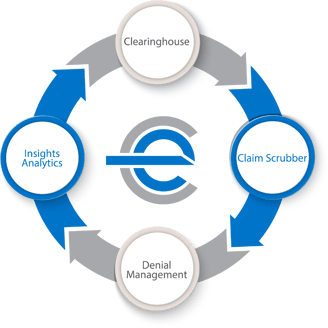

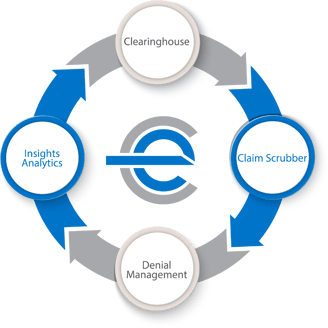

What is efficientC?

As a leader in the denial prevention movement, we love sharing our story.

As a leader in the denial prevention movement, we love sharing our story.

efficientC was born from a need for a better way to manage claims. Built by revenue cycle experts for revenue cycle specialists, we created a revenue cycle management tool to make your transition from a strategy of denial management to denial prevention seamless.

We'd love to show you how efficientC is different. If you’d like to see or learn more, contact us here or send an email to efficientC@os-healthcare.com.