6 min read

Elevate Revenue Cycle Performance by Leveraging Analytics & Business Partner Expertise

By: Lori Zindl on Jul 25, 2019 8:54:39 AM

In our previous Revenue Cycle Matters posts, we discussed the importance of clearinghouse and claim scrubber partners as part of an effective revenue cycle management strategy. We also highlighted the benefits of focusing on first pass yield and clearinghouse features that support positive collection outcomes.

In this post, we turn our attention to another key component of a successful revenue cycle management strategy... Analytics and Reporting.

Analytics & Reporting

We saved this topic for now because the ability of your clearinghouse and claim scrubber to effectively review edits and process claims has a BIG impact on the quality of data in your revenue cycle reporting.

We’ve already emphasized the benefits of electronic claim submission (837s), equally important is having a clearinghouse set up to process a high-volume of electronic remittances (835s or ERAs).

If you receive a significant portion of your remittances via fax or mail, you increase the risk of posting errors and make it much harder to obtain a full picture of your revenue cycle health. You also probably spend a lot of time manually merging claims data from disparate sources to create your reports – which is better than doing nothing, BUT... it could be much easier!

This is another reason why we emphasize the role a clearinghouse should have in staying on top of payer enrollments. Not only does it increase payer response time, save money and ensure compliance, but electronic claim processing also increases the integrity of your revenue cycle data.

More Reliable Analytics

Hospitals should receive 90-95% of their remittances via 835, but often vendors will make that difficult to achieve when they charge by volume or per payer. When the cost and administrative burden of the enrollments becomes overwhelming, providers end up only opting for 835’s from a few of their top payers.

When a hospital’s revenue cycle team maximizes the number of insurers they submit and receive 837s and 835s from, they increase their ability to reconcile the remittance data with the original claim. Which paints a more vivid picture of the lifecycle of their claims and allows for more efficient denial analysis and payer reporting.

If your clearinghouse is the system warehousing these data exchanges, at a minimum it should help eliminate the hassle of manually gathering data from disparate locations. Clearinghouses with a denial prevention philosophy can do one better by providing automated reporting tools, as well as visual representations of your top denials and trends, which saves even more time!

In a 2016 survey, HIMSS Analytics found that 31% of providers did not have a formal denials management tool in place. This number has probably improved since the survey but even in the last year, we’ve visited hospitals who don’t have an efficient and consistent way to report on denials. The main reason being the time-consuming nature of putting the data together in a meaningful way, which is understandable given most days Revenue Cycle leaders don’t have enough time to grab a 2nd cup of coffee!

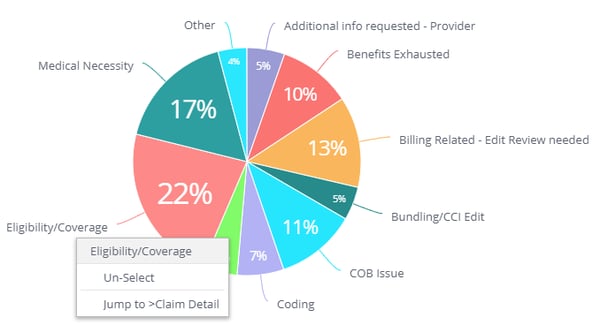

Denial reports and analytics with the ability to drill into specific denial categories and trend performance metrics over time, like those below, are invaluable resources for uncovering opportunities for improvement. Especially when you are ready to take a more proactive approach to how you prevent denials.

Top 10 Denials: Most common denials, where you can drill down to payer and claim level detail

For example, if you see eligibility denials as your #1 offender, drill down and find out which payers are denying most frequently, then look for common themes within those rejected claims. You may find an opportunity at admission to make an adjustment to the patient intake process and prevent those denials in the future. With proper analytics you’ll have the reports to back you up.

As the HIMSS study concludes, denial reporting is not enough. The ability to act on denial data to eliminate future denials is the real key to A/R success. The practice of continuous improvement is just as important as the reporting tools, because technology alone cannot fully automate denial management and there are still issues such as working with payers and adjudicating claims.

Understanding How to Use Your Analytics

Once you have the majority of your claims and remittances matching electronically, the analytics available is virtually unlimited – denial reporting, cash projections, payer scorecards, contract variance. It becomes extremely important to be able to gather this data in an actionable format or it can become overwhelming.

Most clearinghouses provide some level of reporting. Some will provide a high-level snapshot of your data while others provide the ability to drill down into different levels of detail. Access to data and being able to apply that data are two different things. We often work with providers who have access to tons of dashboards and reports, but can’t get through the noise to find what they need to make an impact on A/R and cash performance.

The purpose of denial analytics is to be able to easily identify why your claims are not being paid on first submission – going back to that all important first pass yield rate.

Revenue Cycle Matters Tip: Your clearinghouse support team should be routinely working with your team to find preventable denials and improving the claim scrubber based on the root causes of the payment delays. Turning denials into edits – thereby improving the first pass payment rate for your claims.

First Pass Yield: A Snapshot of your payment success and denial rate over time

Business Partner or Vendor

If your clearinghouse is unable to provide you with the assistance you need to fully leverage its capabilities, you may want to rethink your relationship with that vendor. Are they a vendor or a partner?

When you are with your peers at HFMA, AAHAM or other industry events do you refer to the exhibitors as vendors or business partners? Do you use the two terms interchangeably?

Depending on how great an impact a service provider has on our ability to perform our duties, we make a strong distinction. If we receive office supplies from them and the relationship is more transactional, we’d probably consider them to be a vendor.

If the service they provide has a direct impact on our bottom line or there is potential for them to have downstream interactions with our customers (a clearinghouse checks both boxes) – we look for a business partner.

The technology available to revenue cycle teams today has the potential to increase staff productivity and collections. What good are all these expensive tools if you are not trained to use them properly? Or they can’t easily be customized to suit your hospital’s needs?

Given the impact a clearinghouse has on your day-to-day operations, make sure the company you sign a contract with has the same goals as you do for your hospital’s accounts receivable. They should invest time training your team to use the system effectively, collaborate with them to understand the root cause of denials and be accessible when you need a new edit or to set up a new electronic payer enrollment.

In addition to efficiencies gained by having a single platform for clearinghouse, claim scrubbing and reporting services your revenue cycle can achieve higher levels of productivity with business partners you trust.

Create your own user feedback survey

Choose Denial Prevention

At efficientC, we take a denial prevention approach to claims management. Our clearinghouse software and our client experience team are both hardwired to stop likely rejections from reaching payers before they can become a denial.

Our analytics platform lets users identify where and why denials are occurring. All the way down to the claim detail. When it comes to your A/R, we share the same goals and our client experience team is there to help your team understand and use analytics to increase collections. We meet at least quarterly with every client to ensure they understand what is happening in their revenue cycle.

As a leader in the denial prevention movement, we love sharing our story. efficientC was born from a need for a better way to manage claims. Built by revenue cycle experts for revenue cycle specialists, we created a revenue cycle management tool to make your transition from a strategy of denial management to denial prevention seamless.

We'd love to show you how efficientC is different. If you’d like to see or learn more, contact us here or send an email to efficientC@os-healthcare.com.

For more revenue cycle management insights and collections best practices, stay tuned for the next installment of Revenue Cycle Matters.

Related Posts

How do You Measure Revenue Cycle Management Success?

Debunking the Clean Claim Rate Fallacy

Benchmarking the effectiveness of a clearinghouse can be...

Adoption of Telehealth Services Surging

It’s been said that now is boom time for telehealth in the US, but that may be an understatement.

...

Measuring the Cost of Denials and the Impact of Prevention

When it comes to denial management, there is no “one-size-fits-all” approach.

Different...