Over the past 10-15 years, technology in healthcare administration has advanced by leaps and bounds. Gone are the days of paper charts and separate platforms for pharmacy, physician orders, and documentation. The introduction and rise in popularity of the EMR has opened a whole new world of efficiency, centralization, and data collection.

Similarly, automated billing and business intelligence tools have accelerated back-end processes and paved the way for extensive data gathering. Healthcare leaders can measure anything and everything with the right tools at their fingertips.

This real-time access to data has the potential to provide valuable insight into staff performance, financial benchmarking, process shortfalls, departmental efficiency, and more.

Questions Remain

For healthcare leaders, the question becomes, “Are we harnessing and using the data we have to its fullest potential?” Especially now, with lower revenue and challenges related to billing telehealth visits, it is crucial for billing departments, in particular, to be closely monitoring the data they collect.

- But which key performance indicators (KPIs) are the most important?

- How can healthcare organizations harness KPI data and make it accessible to all staff members?

- And finally, how can all this data be used on a consistent basis to evaluate staff, departmental, and organizational performance?

This article, based on a recent efficientC webinar, aims to answer these questions and give healthcare leaders a clear path forward as they work to build out processes that are backed by solid data.

Top 6 KPIs to Track in the Business Office

The revenue cycle is made up of a constant flow of data--from the moment a patient enters the system until that patient’s account has reached full resolution. Data that has completed its journey through the revenue cycle and has reached the business office can then be sliced and diced in countless ways while giving valuable insight into the organization’s overall performance.

Below is our list of the top 6 KPIs to track in the business office as well as specific benchmarks for each:

|

Goal: < 15% |

Goal: ~30 days |

Goal < 7 Days |

|

Goal: 85% of claims resolved within 30 days |

First Pass Yield Goal: 95% |

Denial Rate Goal: < 5% |

How to Build a Great Scorecard around KPIs

Once you have defined the KPIs you are most interested in tracking, including them in a well-designed scorecard makes relevant data accessible to staff members at any level.

What features make a great scorecard?

What features make a great scorecard?

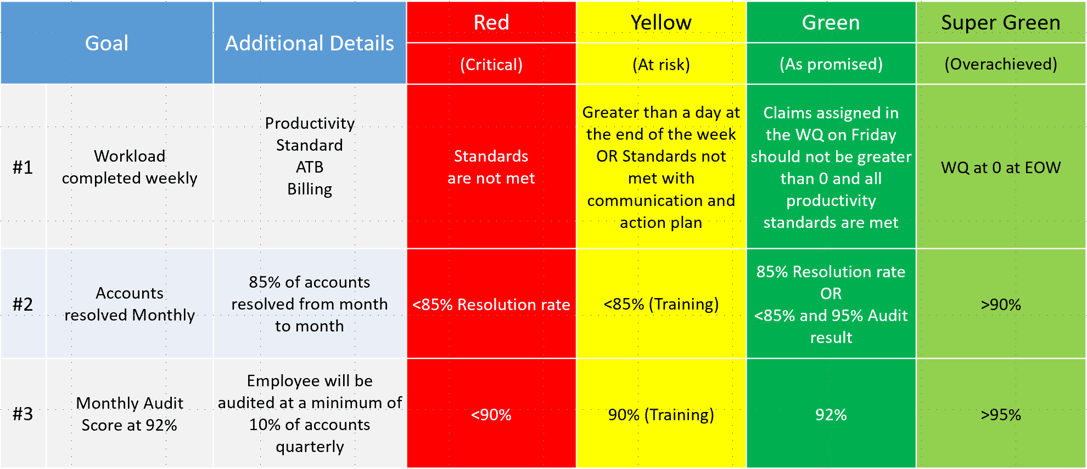

- Color coding. A great scorecard uses color coding to indicate whether goals are being met. For example, the colors green, yellow, and red can indicate whether results are meeting goals, falling below target and needing to be monitored, or in need of corrective action.

- No secret KPIs. Allow staff members the opportunity to understand exactly how they and the department are being evaluated. This sets clear expectations and gives them ownership over their performance.

- Multi-dimensional. The best scorecards are nimble and allow users to view and filter data in a variety of ways. For example, efficientC’s Denial by User dashboard allows users to drill down into denials by registrar, coder, biller, and physician.

- User friendly. The scorecard ought to be a place where staff feel comfortable going. Data is easy to export, and print if needed, easy to access from anywhere, and easy to navigate by using simple clicks to drill down or compare across departments, individuals, etc.

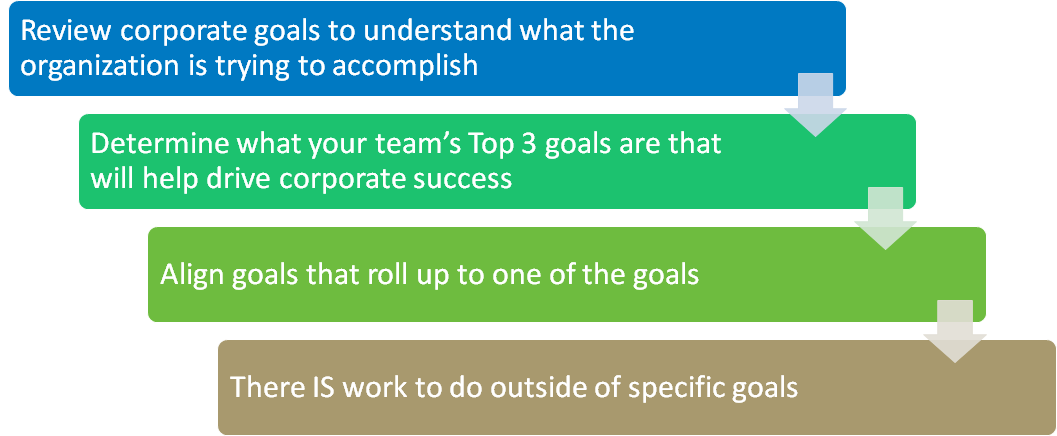

- Integrate organizational goals. When developing performance goals for your team, keep organizational goals in mind. This way, your scorecard will not only reflect individual and team performance but also illustrate how the team’s performance impacts the organization at large.

Using Staff Scorecards to Boost Accountability and Performance

While using scorecards to evaluate staff performance is not a new idea, revenue cycle leaders can certainly benefit from evaluating how scorecard data is being used on a regular basis. For example, are staff members included in discussions about how individual and departmental goals support organizational goals? Conversations like these can provide amazing visibility into how each individual contributes to the overall health of the organization.

Additionally, after sharing organizational goals with team members, empower them to set their own specific goals and success criteria. They can ask for guidance but allow them to develop their own plan to achieve “success.” This gives them ownership over their tactics for “getting to green” and makes them more likely to achieve their goals.

To further support team members’ sense of ownership over their performance, ensure each individual has a full understanding of the scorecard’s function. They should know how their results are found and even be able to pull them themselves.

Performance, challenges, and progress can be discussed during monthly one-on-ones. Again, the goal is to empower team members to have ownership over their own performance. While they are welcome to ask questions about how to work certain accounts, they are also encouraged to use an approach that works well for them.

If you would like to learn more about how efficientC’s Insights predictive analytics platform can help your organization track vital KPIs and build scorecards that effectively promote a culture of performance and problem solving, you can reach out to efficientC here.

Our Promise

At efficientC, we promise to help our customers get 95% of their claims paid in twenty days or less. For us to achieve our promise, we must take an active approach to denial prevention. We know that if a claim gets denied, there is a 60% chance that claim will get denied again. Why take that risk? When implemented correctly, our customers have seen on average a 15% cash flow improvement and a 40% reduction of denials in sixty days.

Most claim scrubbers have the data you need to be successful. If you are struggling to find the data, reach out to your current vendor/partner and ask for assistance. Chances are, other customers have asked the same question and they can point you in the right direction.

We hope that the information that we have provided today can help you and your organization take steps to implement a denial prevention strategy. It might take some effort to get started but in the long run, it will increase collections and speed up your A/R turnaround. If you need some help getting started, reach out to us at efficientC. We would be happy to provide a free denial analysis. It’s time to make your denials work for you. We are here to help.

Do not forget to subscribe to Revenue Cycle Matters for healthcare billing best practices and industry tips!

Related Posts

Adoption of Telehealth Services Surging

It’s been said that now is boom time for telehealth in the US, but that may be an understatement.

...

Using ATB Reports and Resolution Rates to Help Run a More Effective Billing Office

Last April, OS team members had an opportunity to attend the Hawkeye AAHAM Spring Conference....

Revenue Integrity in the Business Office

efficientC: Your Partner in Revenue Integrity

Revenue integrity is a phrase used across many...