5 min read

Discussion of Claim Integrity Task Force Report

By: Dave Glyzewski on Apr 29, 2021 1:12:55 PM

With the recent release of the report from HFMA’s Claim Integrity Task Force: Standardizing denial metrics for

revenue cycle benchmarking and process improvement, we thought it would be worthwhile to get persp

ective from one of efficientC’s denial prevention experts. Earlier this week, we sat down with our President Lori Zindl and discussed the report and some of its findings.

What was your initial reaction to the report?

My first reaction could be summed up in one word really – Finally! Denials are costly to hospitals, so it’s great to see a report that gives providers a path to improvement. The addition of Initial Denials as a KPI is critical as it provides insight into what is truly keeping you from collecting third-party receivables on first submission.

We’ve been tracking this KPI for years – we call it First Pass Yield.

The HFMA report listed Initial Denials as the first measurement in the report, my hope and assumption are that by putting it first, they understand and are promoting its importance. Tracking initial denials by root cause category and then taking action to prevent future denials is the foundation of how efficientC operates. If done correctly, you can get 90-95% of your claims paid in 20 days. Just ask our clients.

Why is "Initial Denial" or First Pass Yield so critical?

When your initial claim is denied by a payer, you have less than a 40% chance of getting paid when you resubmit. You have a 60% chance it will deny again which causes delays in cash flow, increases aging of the A/R, and the chances of ultimately having to write off the balance and losing reimbursement.

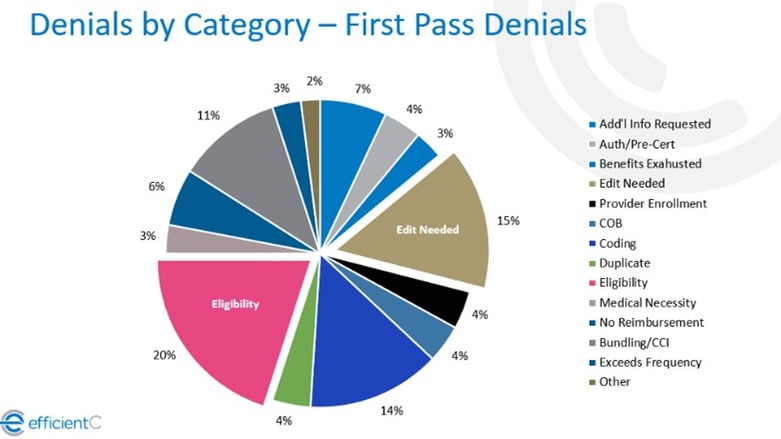

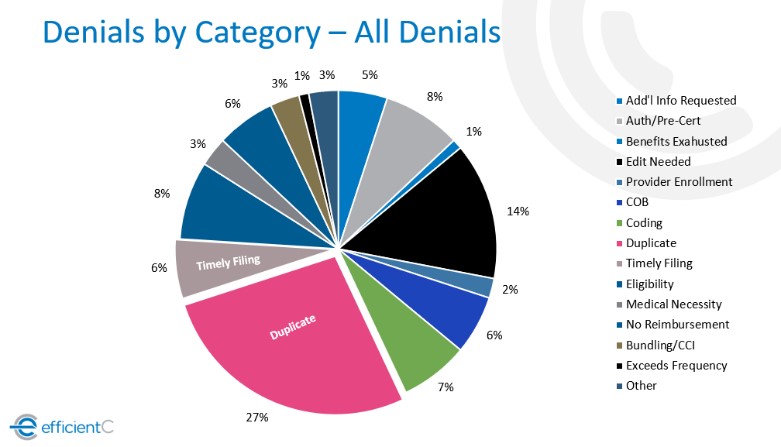

Tracking initial denials also provides more insight into the reasons for your denials. The graphic below shows how the top initial denials tend to be eligibility-related and denials that could be prevented with upfront claim edits (see edit needed category). When using data on all denials, duplicate claim denials often skew the data which makes it more difficult to isolate the real issue behind the payment delay.

Do you have any recommendations for how to reduce "Initial Denials?"

The first step is tracking initial denials using payer reason/remark codes that are mapped to root cause categories. Then go after your highest dollar and highest volume by claim count each month to find ways to prevent those denials in the future.

Most denials are preventable as they usually relate to data on the claim that can be corrected prior to submission to ensure timely payment. The process includes adding claim edits upstream to ensure that data is correct before releasing it to the payer. Using a decision support tool such as efficientC that incorporates active learning into the process makes it much easier.

Payers are always changing their rules, so it’s important to have data updated routinely to maintain a high First Pass Yield Rate.

You've done presentations recently discussing how First Pass Yield (Initial Denials) can be used as a cashflow predictor, can you elaborate on why that it is?

CFOs and other leaders in hospital finance have historically not looked at denials as a key metric at the organizational level.

They tend to view it as a responsibility exclusive to their revenue cycle leaders and the hospital business office. I have always worked in the revenue cycle and it seems odd to me that the CFO does not pay more attention to denials and the impact they have on cash flow, speed of collections and ultimately, reduction in write-offs.

Bottom Line: If you know your organization’s monthly claim volume (in dollars) and you know your First Pass Yield rate, you have a great indicator to predict cash on a monthly basis.

If denials are the domain of the revenue cycle, how do you transition so the organization makes it a priority?

We’ve been preaching to revenue cycle and finance leaders that denials aren’t just the responsibility of the business office since day one.

Sure, that’s where they must be worked, but that’s not where all the preventable denials originate. Registration, coding, and physicians all play a role in denial prevention.

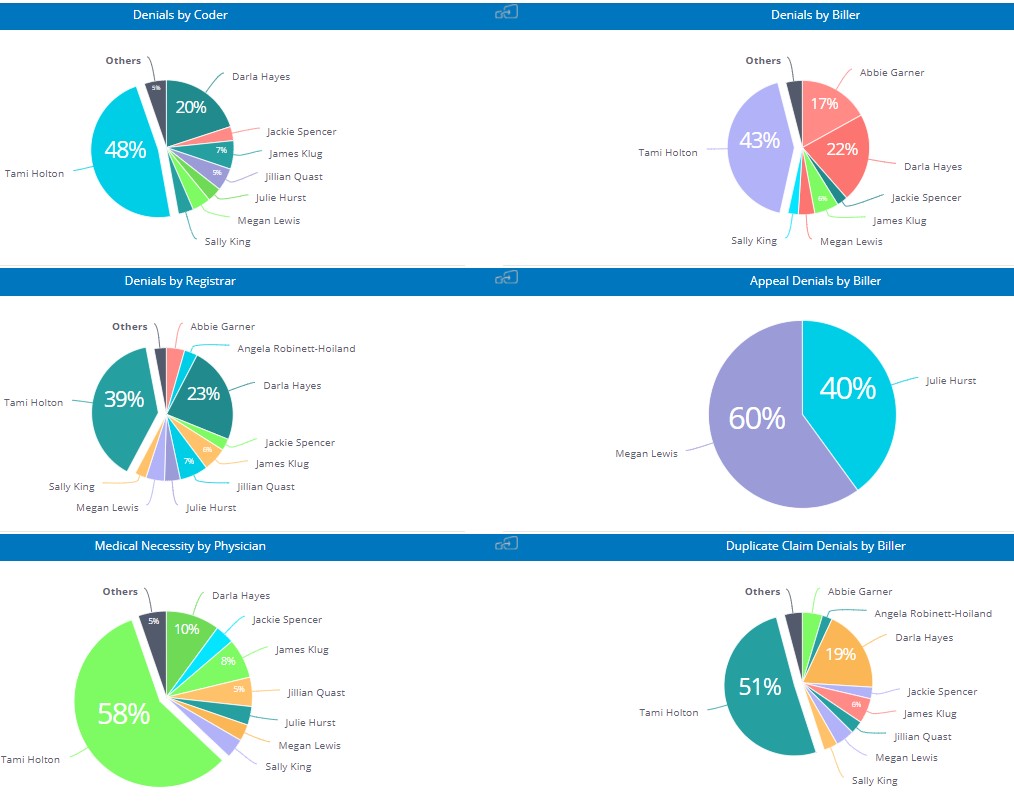

One of my favorite dashboards in efficientC identifies where a denial originates. efficientC’s Denial by User dashboard shows the department where a denial originated from.

This can help put a spotlight on where the organization, not just those in the revenue cycle, must make adjustments to help improve their First Pass Yield rate. If the entire organization puts an emphasis on denials, your first pass yield rate will improve and bring in more cash faster. We know that a claim that gets paid on first submission is most likely going to get paid within 20 days or less.

Therefore, if you know your overall claim volume (in dollars) you can predict the cash that will come in over the next 20 days.

Our Promise

At efficientC denial prevention is our business. If you’re not focused on your First Pass Yield rate (HFMA’s Initial Denial Rate), you’re probably more focused on denial management than denial prevention. We would love to help change the way your organization views and manages your denials. If you’d like to talk to one of our denial subject matter experts, reach out to us here.

Do not forget to subscribe to Revenue Cycle Matters for healthcare billing best practices and industry tips!

Related Posts

Denial Madness Tournament Bracket Update - And Then There Were Four

Well, we’re down to the last four denials (just like that other tournament). If you haven’t been...

Denial Madness Tournament Bracket Winner!

Well, that went fast, didn’t it? We have our champion in the Denial Madness Bracket Tournament – ...

4 Revenue Cycle Trends to Watch in 2022

Over the past two years, strategic planning for healthcare leaders has primarily consisted of...