Over the past two years, strategic planning for healthcare leaders has primarily consisted of tackling pressing issues head-on while other less-pressing plans have taken a back seat. The COVID-19 pandemic and legislation related to price transparency and the No Surprises Act have dictated revenue cycle leaders’ to-do lists.

As we roll into 2022, however, leaders may find they have the bandwidth to address some of the other trends we’ve been seeing in the revenue cycle world. If you are ready to put some strategic plans in place of your own choosing, here are 4 revenue cycle trends you may wish to address in the new year.

Remote Work is Here to Stay

Remote work in the revenue cycle – especially for the hospital billing office – is nothing new; this topic has been trending over a number of years. The COVID-19 pandemic has significantly accelerated the shift toward remote environments, and it’s likely that your organization’s business office is now either partially or fully remote.

In fact, a recent Owl Labs survey found that in 2020, 70% of full-time workers in the US were working from home. Additionally, the same survey found that 1 in 2 people will not return to jobs that don’t offer remote work after COVID-19.

Now is the time to embrace remote work as a viable and even beneficial arrangement. If your organization has been treating remote work as a temporary fix, you may want to consider taking the necessary steps to make remote work a permanent fixture.

We recently published an article featuring all of our best tips for successfully supporting a remote business office. It covers making sure remote workers have the tools they need to be successful, monitoring performance, communicating expectations, maintaining company culture, and more.

Simplifying and Understanding Your Data

The most successful healthcare organizations are driven by data. On the clinical side, patient care standards and protocols are decided based on data from thorough research and studies. Similarly, revenue cycle best practices and process improvements can also be established using reliable data.

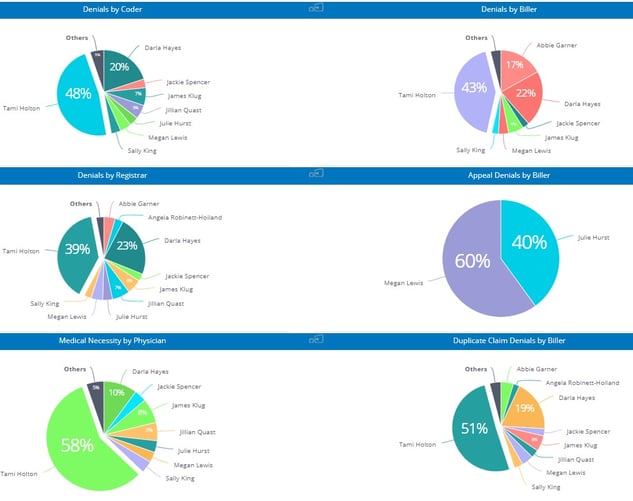

While we all know this to be true, harnessing your data in a way that is meaningful and actionable can be a challenge. For this reason, some claims management systems, like efficientC, include easy-to-read dashboards and analytics that provide valuable insight into how well your organization is performing. For example, efficientC’s Denials by User Dashboard can pinpoint the origin of denial types. This type of dashboard and data is easy to use and provides very actionable intelligence. All of efficientC’s dashboards and analytics embrace a denial prevention strategy, that puts the emphasis on key indicators like first pass yield, to help get the highest percent of claims paid upon first submission.

In 2022, work closely with your claims processing partner to deliver the data that is available in a relevant and easy-to-use manner. Most systems do provide relevant data, take the time to find and organize the data in a way that effectively incorporates the strategies your revenue cycle needs to be successful.

Click here to learn more about how powerful analytics can drive performance improvement.

Labor Shortages and Outsourcing

Over the past year, we have heard first-hand from our customers about the challenges of keeping a fully staffed revenue cycle department. At OS inc., we offer both temporary and permanent offsite business office support. Our team members are trained to work as a seamless extension of your team. Our philosophy and tools are designed to reduce claim touches and get the most claims paid on first submission. With a solid outsourcing partner your accounts can be in good hands.

Outsourcing is one way to mitigate internal labor shortages. It may be time to consider ways to make your revenue cycle more efficient through artificial intelligence (AI) driven automations. Many AI-based solutions have been around for some time and are now reaching the maturity required to make them cost-effective. Solutions like virtual agents that use conversational-AI can help reduce staffing needs in registration and back-end collections. These solutions are available and being put into practice today. Likewise, maybe it’s time to consider automating more of your prior authorization, medical coding, and eligibility activities. All these solutions could allow you to reduce your overall staffing requirements and allocate personnel to areas of need.

Slimming Margins for Healthcare Organizations

It’s no secret that healthcare organizations are operating on very slim margins. With the “patient as payer” trend on the rise, cost to collect can often increase–causing margins to narrow even more. Moreover, profits took a major hit over the past couple of years when healthcare providers were forced to shut down entire service lines in response to the COVID-19 pandemic.

While government emergency grants and temporary funding have certainly helped during this time of crisis, it’s looking as though COVID-19 is here to stay. As the world adjusts to this new cyclical virus, the financial aid from the government is likely to end.

In the coming year, revenue cycle leaders would be wise to aggressively pursue avenues for with potential to reduce costs and improve efficiency across all departments. Our recent article highlighting Revenue Integrity in the Business Office outlines a variety of actionable steps organizations can take today to limit their exposure to compliance risk and stop revenue leakage in its tracks.

For example, clinical documentation improvement programs, denial management software, denial prevention strategies, business intelligence tools, customizable dashboards, and strong inter-departmental cooperation can all work together to create real, long-lasting improvements.

As leaders in the healthcare industry, we’ve figured out how to adjust our processes and policies in light of the COVID-19 pandemic. In planning for the upcoming year, take some time to put in place a few strategic plans of your own choosing.

We’re here to help. If you are interested in getting in touch with our revenue cycle management experts, contact our team today here.

Our Promise

At efficientC, we promise to help our customers get 95% of their claims paid in twenty days or less. For us to achieve our promise, we must take an active approach to denial prevention. We know that if a claim gets denied, there is a 60% chance that claim will get denied again. Why take that risk? When implemented correctly, our customers have seen on average a 15% cash flow improvement and a 40% reduction of denials in sixty days.

Most claim scrubbers have the data you need to be successful. If you are struggling to find the data, reach out to your current vendor/partner and ask for assistance. Chances are, other customers have asked the same question and they can point you in the right direction.

We hope that the information that we have provided today can help you and your organization take steps to implement a denial prevention strategy. It might take some effort to get started but in the long run, it will increase collections and speed up your A/R turnaround. If you need some help getting started, reach out to us at efficientC. We would be happy to provide a free denial analysis. It’s time to make your denials work for you. We are here to help.

You can reach out to efficientC here.

Do not forget to subscribe to Revenue Cycle Matters for healthcare billing best practices and industry tips!

Related Posts

How do You Measure Revenue Cycle Management Success?

Debunking the Clean Claim Rate Fallacy

Benchmarking the effectiveness of a clearinghouse can be...

Adoption of Telehealth Services Surging

It’s been said that now is boom time for telehealth in the US, but that may be an understatement.

...

Elevate Revenue Cycle Performance by Leveraging Analytics & Business Partner Expertise

In our previous Revenue Cycle Matters posts, we discussed the importance of clearinghouse and claim...