While often overlooked by healthcare executives, your clearinghouse is arguably the most important piece of technology in the revenue cycle. In addition to transmitting claims to payers, the clearinghouse is also responsible for scrubbing claims for accuracy and providing valuable insight into denials and overall performance.

How do you know if your clearinghouse is living up to its potential? If your clearinghouse is NOT performing effectively, you are leaving revenue on the table. To determine how well your clearinghouse is performing, we recommend tracking two key benchmarks: First Pass Yield (FPY) and Denial Write-offs as % of net patient revenue (NPR).

Key Benchmarks for Evaluating Performance

First Pass Yield: Measures the percent of claims that get paid on first submission.

FPY Industry Standard: 85%

FPY efficientC Average: 92%

Why is this important?: Unlike the typical “clean claim rate,” which simply measures the percent of claims that pass clearinghouse edits upon first submission, FPY provides valuable insight into how many submitted claims are actually being paid by the insurer the first time. For example, if your clean claim rate is high, but your FPY is low, that means your clearinghouse is transmitting claims that are ultimately being denied by payers.

Every claim that does not get paid on first submission incurs a cost to your business office. For every denial, your business office staff have to spend time re-working and re-submitting claims. Furthermore, your organization is missing out on the revenue that is tied up in those denied claims. Actively working to increase FPY will improve cash flow while also saving a great amount of time and effort (cost).

Denial Write-Offs: Written as a percent of net patient revenue, this value represents the amount of denied claim dollars that are unable to be collected after all avenues for appeal have been exhausted.

Denial Write-Offs as % of NPR Industry Standard: Less than 3%

Denial Write-Offs as % of NPR efficientC Average: Less than 1%

Why is this important?: This number provides a clear picture of the dollar amount that is ultimately lost due to denials. To make this benchmark easy to compare across a variety of organizations, it is typically written as a percent of NPR. If your denial write-offs are in the 3%-5% range, you are most likely leaving significant revenue on the table.

Taken together or by themselves, a low FPY and high denial rate tell us that you could very well expect more from your clearinghouse or claim scrubbing partner.

Where does your clearinghouse stand? Are you leaving money on the table?

The efficientC Impact: A Case Study

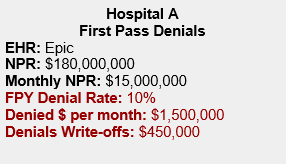

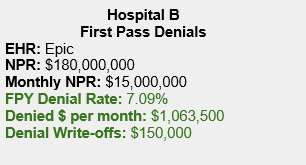

To answer these questions, look at the comparison between hospitals A and B below:

Hospital A represents organizations currently achieving the industry average denial rate of 10% and a 3% FPY denial write-off on monthly NPR. Hospital B represents organizations achieving the average denial rate for efficientC customers and a 1% denial write-off.

This means that on average, a small to medium efficientC customer would saving an extra $736,500 every month, which translates into an annualized amount of over $8.8 million each year.

efficientC is a denial prevention platform, designed to stop and fix claims prior to billing. On average, our clients see 90-95% of claims paid within 20 days, a 15% overall improvement in cashflow, and a 40% reduction in denials after just 60 days.

Put Your Clearinghouse to the Test

If your current clearinghouse isn’t delivering similar results, it may be time to consider looking elsewhere. Don’t spend another year in an underperforming relationship. Reach out to one of the experts at efficientC. We offer a free denial analysis where we can take copies of your claim and remittance data to create an Impact Model that will show you how your current claim scrubber compares to the efficientC claim scrubber.

For more about our free denial analysis: go here.

Don’t wait! Every day your clearinghouse is not running at peak performance, costs real dollars and puts more stress on your personnel. If you have questions or would like to talk to us, we are here to help.

Do not forget to subscribe to Revenue Cycle Matters for healthcare billing best practices and industry tips!